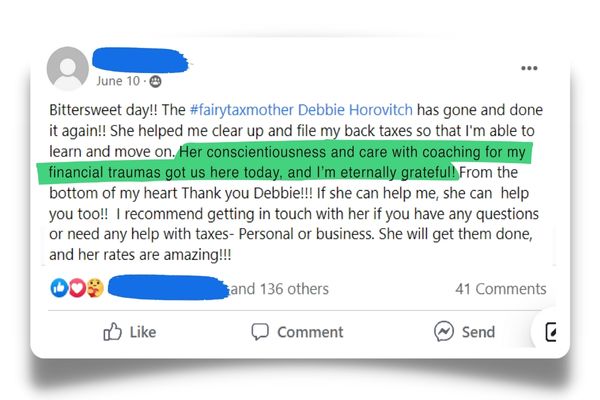

At the start of the pandemic, Horovitch completed her first tax office seasonal contract and was unsure what to do next. To generate some income she shared in a Facebook group about her experience of avoiding taxes for self-employment for ten years, the CRA’s unnerving efforts to get her to file, and the lessons learned on her journey to overcome financial illiteracy. She encouraged people with messy situations to reach out for a different type of help, and the post exploded with comments that triggered a stream of people messaging her to see if she could help. Since then referrals and testimonials generate most of her clients.

Why it happens is largely a mystery, but Horovitch feels it’s likely due to a key difference in the tax systems of the USA and Canada: Americans are generally taxed low on their paychecks, and then owe a balance of income tax to the IRS the following year, while Canadians are taxed much higher on their paychecks and so most tax returns have refunds.

According to the EFILE Association of Canada, the 2021 tax season saw 74% of tax returns had a refund amount, or would likely qualify the taxpayer to receive benefits (Nil returns). As a result, the CRA focuses the majority of their resources on the people they know are most likely to owe taxes, and this allows anxious Canadians to continue avoiding filing their back taxes.

But aside from potentially losing out on expired amounts, extremely late-filing of taxes can create a unique type of stress and anxiety that most tax professionals are unable to truly understand, because they’ve never been multiple years late themselves, and because tax office marketing commonly focuses on also attracting sophisticated bookkeeping and corporate tax clients. Also, many tax offices are only open for new clients from February to the end of April each year, adding to the difficulty some people face in finding skilled help.

All these factors combine so that many people who fall behind on their taxes will just stop looking for help, and as a result unknowingly lose out on years of credits and benefits when the returns expire, ten years after the filing deadline. In some cases, especially people with children under age 18, expired tax returns can mean losing out on more than $10,000 per year in benefits.

Horovitch takes on new clients throughout the year, focusing on people who are up to ten years behind in filing, so that she can take the extra time they need to fully address their feelings about taxes and money.

Where many tax offices try to have their clients completed in less than an hour, initial calls with the Tax Fairy Godmother are often 45 minutes or longer. Then tax returns are worked on virtually, from her home office, with access to client information on the CRA website. Most clients will have an initial calculation of their tax situation estimated within 24 hours. This gives her clients immediate relief of their fears over potentially owing a large balance, because most will have a refund.

Horovitch also counsels her clients on their financial hygiene and makes referrals to other professionals if clients need more assistance than just tax returns. One of the common referrals she makes is to business author Mike Michalowicz and his books on key small business pillars of success, including his money management books PROFIT FIRST and the related children’s book My Money Bunnies.

Both books help people manage their money mindset and behaviours better, so they can reduce or eliminate the killer stress related to money issues. Horovitch has a special connection to Michalowicz’s books: her story of avoiding self-employed bookkeeping for years inspired Michalowicz to self publish PROFIT FIRST in 2014, as shared in the introduction.

Horovitch says “I don’t just do taxes for people. I hold a discreet, non-judgemental space for my clients. After speaking with me I want them to feel empowered and capable that they can overcome any financial stress they might be facing, and take control of their money mindset, to grow their self-confidence and help ensure their professional success. It’s not uncommon for people to say at the end of a call with me, it was like having a tax therapy session, and that they already feel a lot less stressed – that’s the most fulfilling thing for me to hear.”

Many of the tax credits that can be valuable for people to know about, need to be applied at the time of purchase or keep their receipts to document their qualification. To help people recognize the very common credits they can access throughout the year, Horovitch has published a Tax Tips eBook which is available for free on her website at https://start.taxfairygodmother.ca